Managing strategies on DefiEdge

It has been a year since the launch of UniswapV3. So many of us have benefited from lower slippage and more efficient fee market making. The concept of concentrated liquidity provisioning has been a paradigm shift of decentralized exchanges whose repercussions we do not yet fully understand.

Managing liquidity UniswapV3 can challenge the savviest and well-resourced managers. As prices fluctuate, the continuously changing market landscape requires deft rebalancing and disciplined monitoring of liquidity positions. Many protocols have arisen to address these issues. Protocols like Arakis Finance (previously G-Uni) allow passive investors to get exposure to the enhanced fees from UniswapV3; they do not allow liquidity providers to exploit the full breadth of the advantages of UnswapV3.

With DefiEdge, we aim to create the next layer of liquidity management on top of UniswapV3. Professional market makers can transparently manage crypto assets without exposing themselves to the non-custodial and ever-growing regulatory risks associated with centralised risks of centralised exchanges.

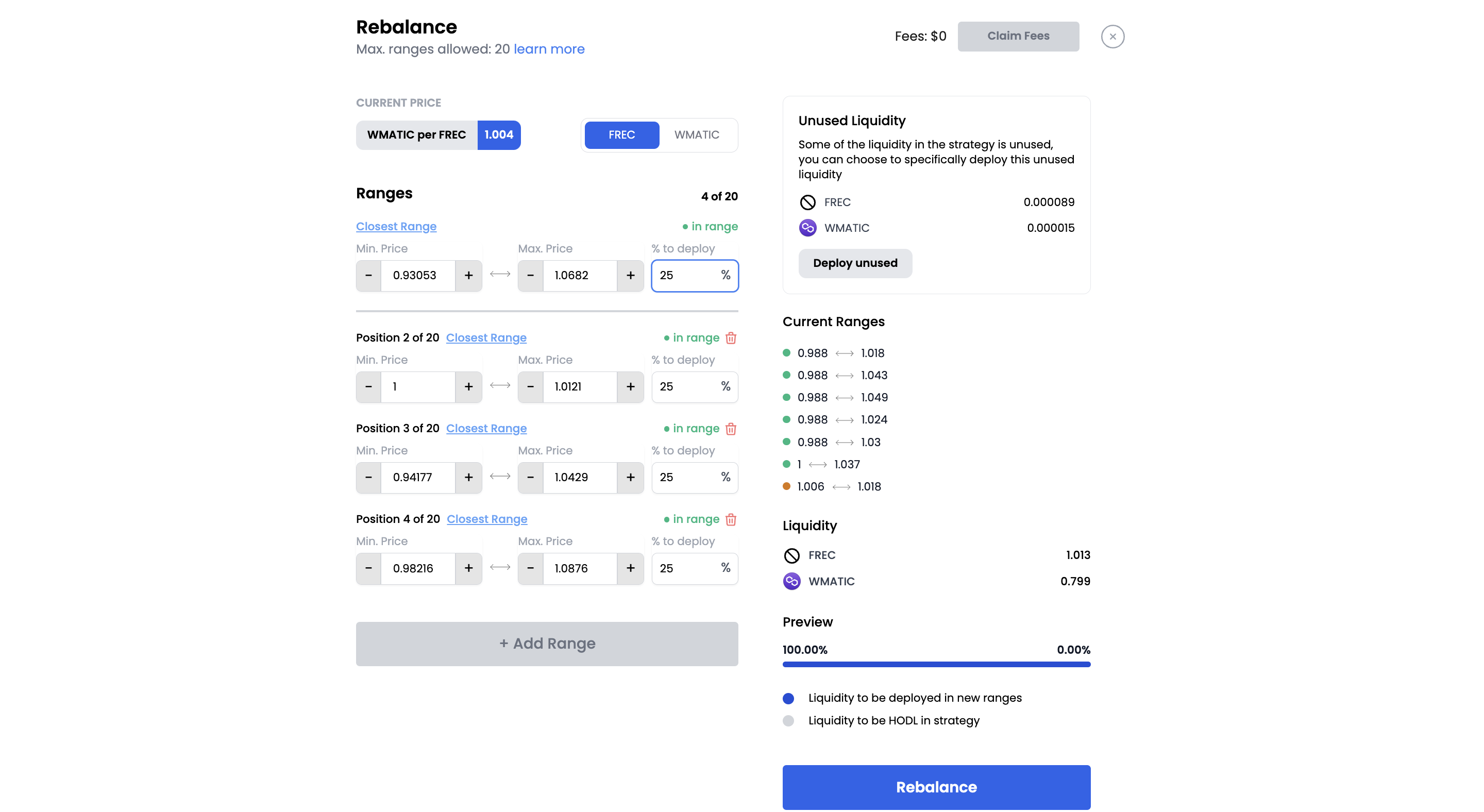

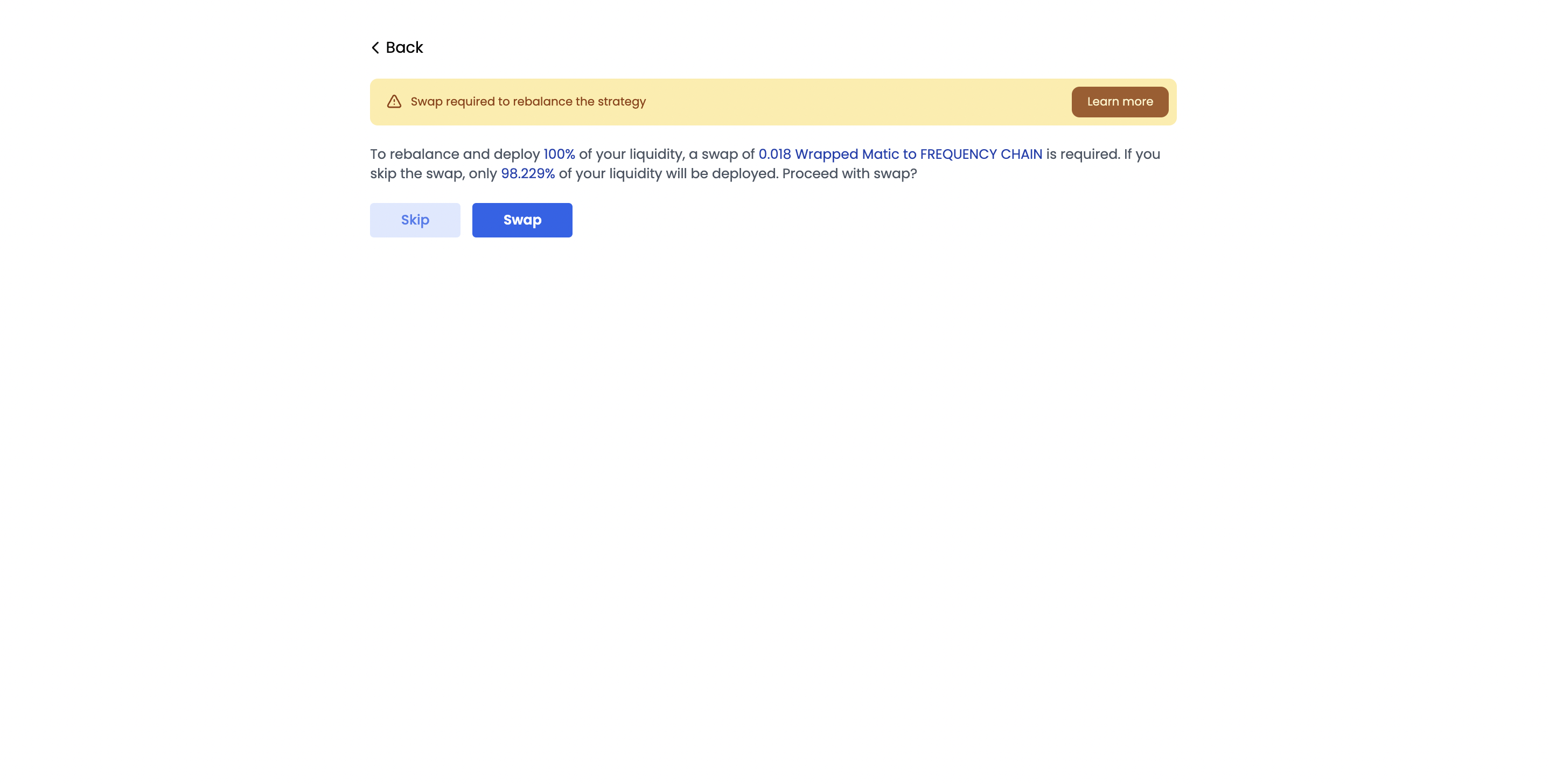

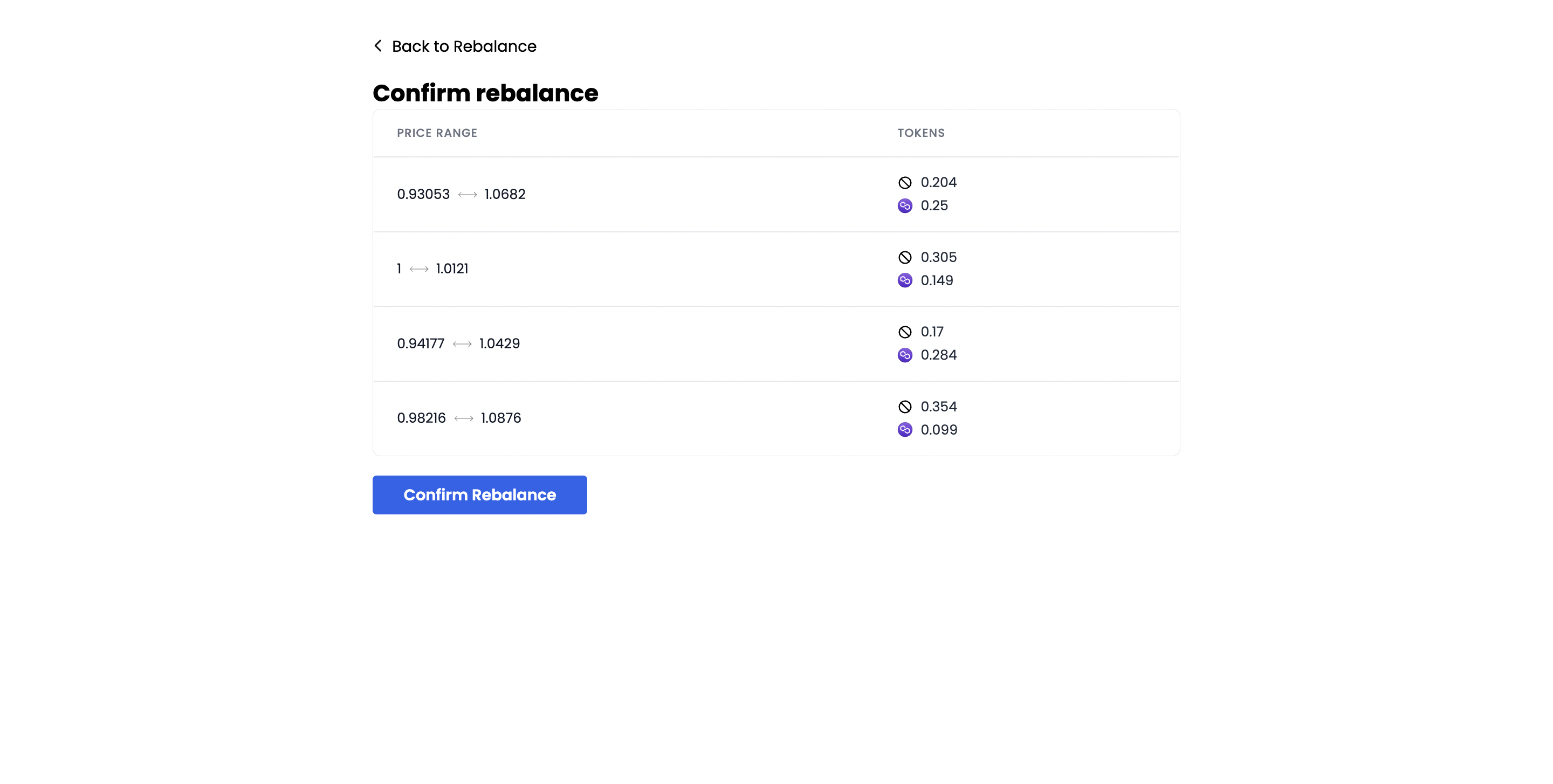

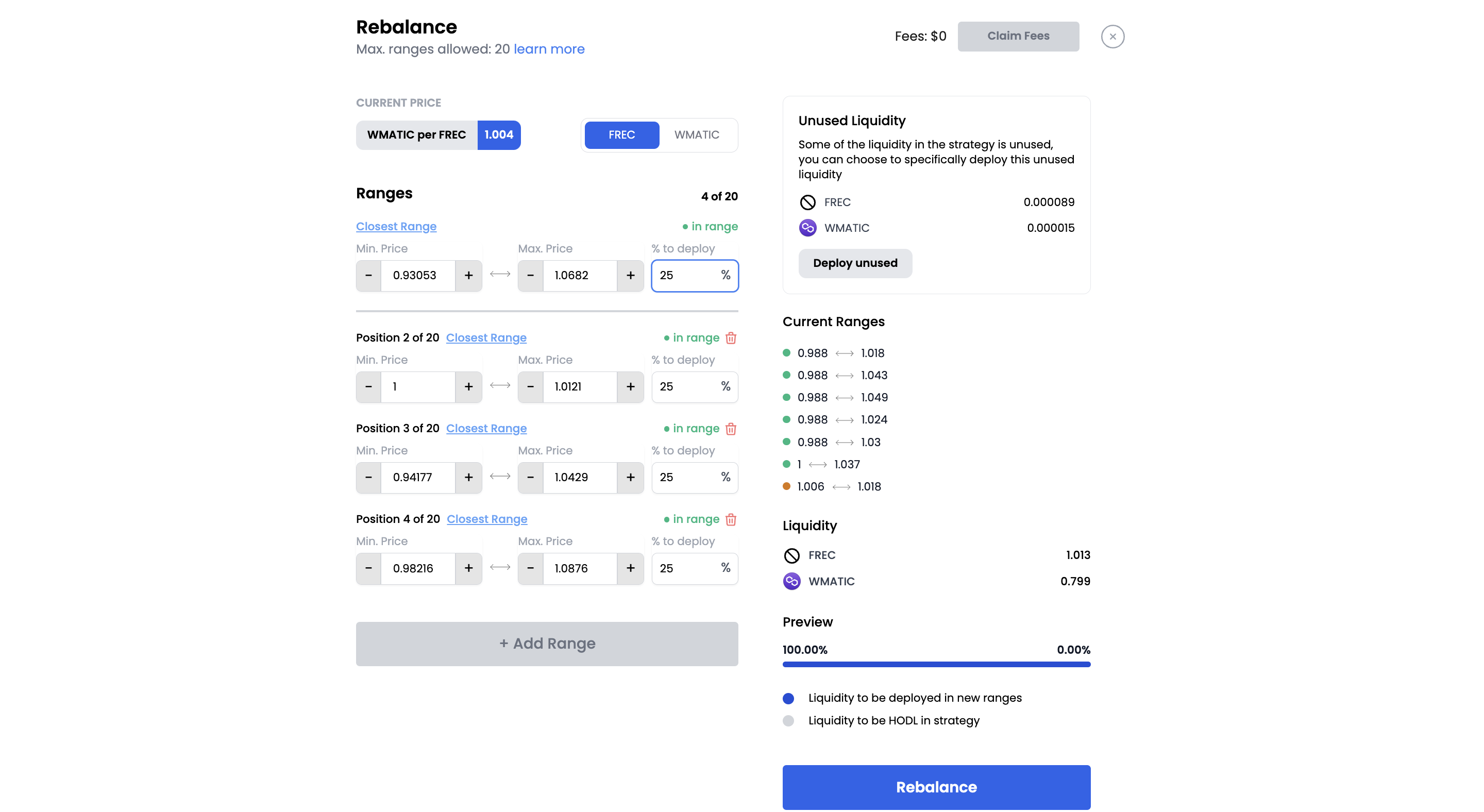

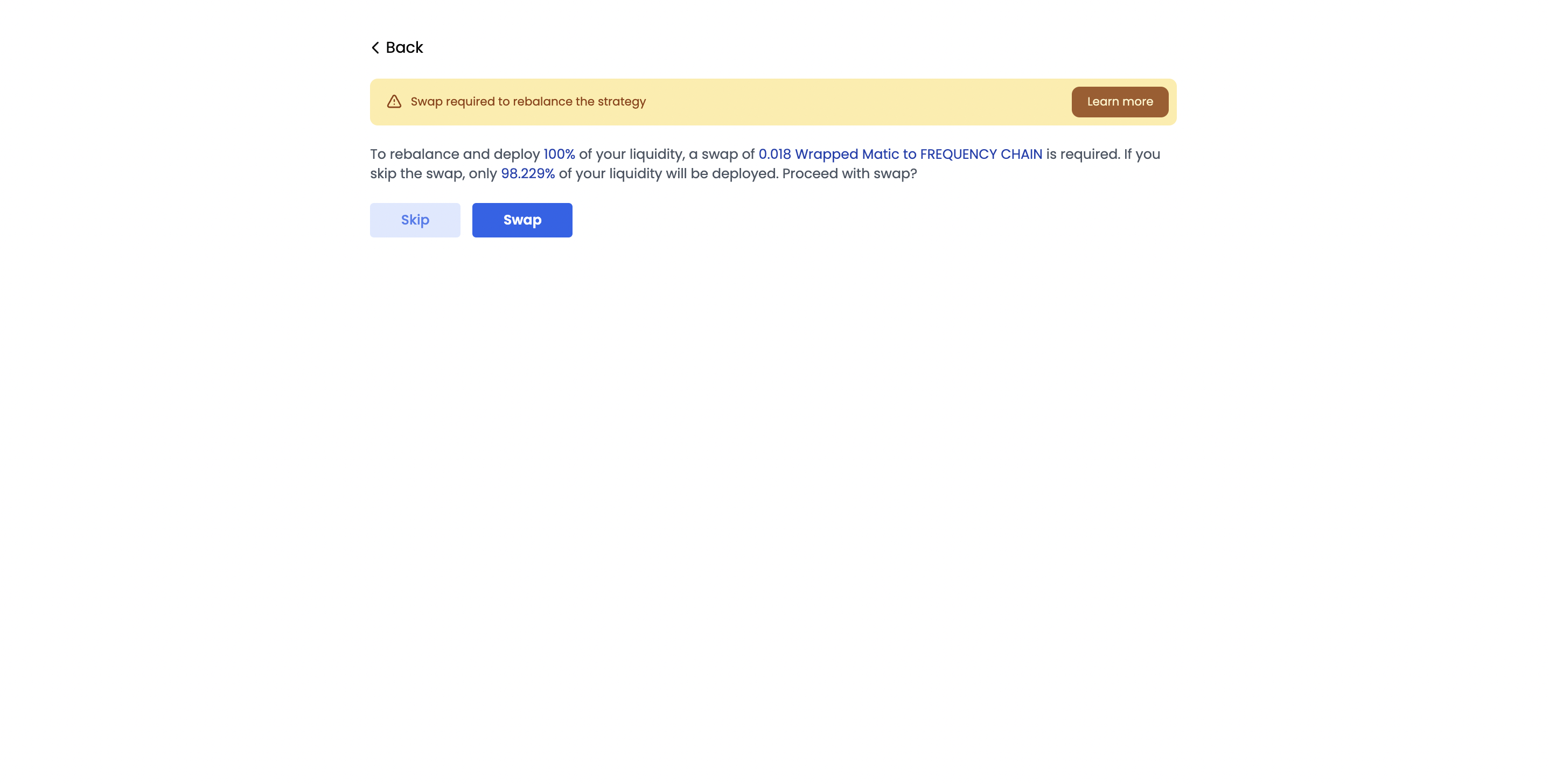

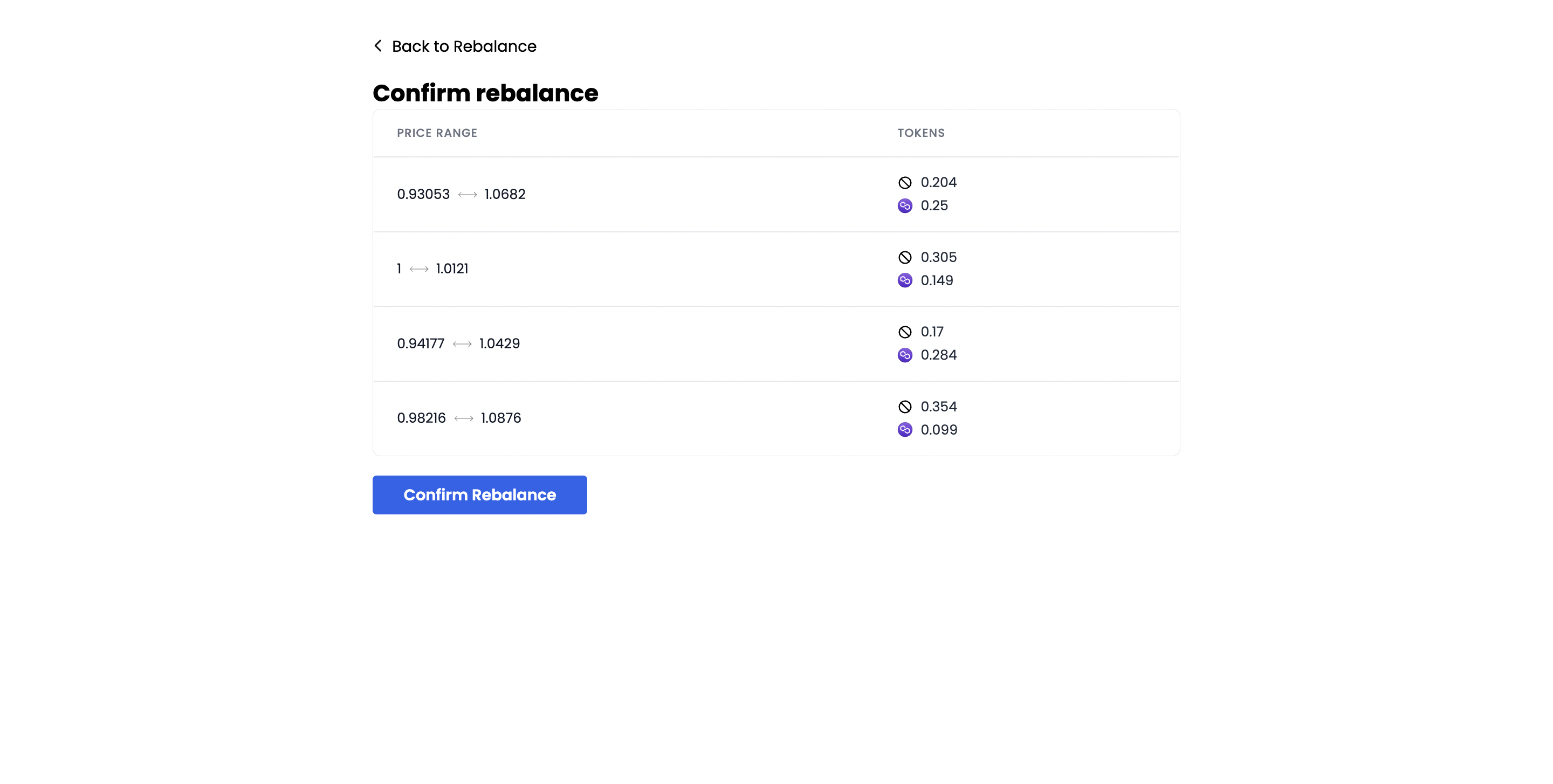

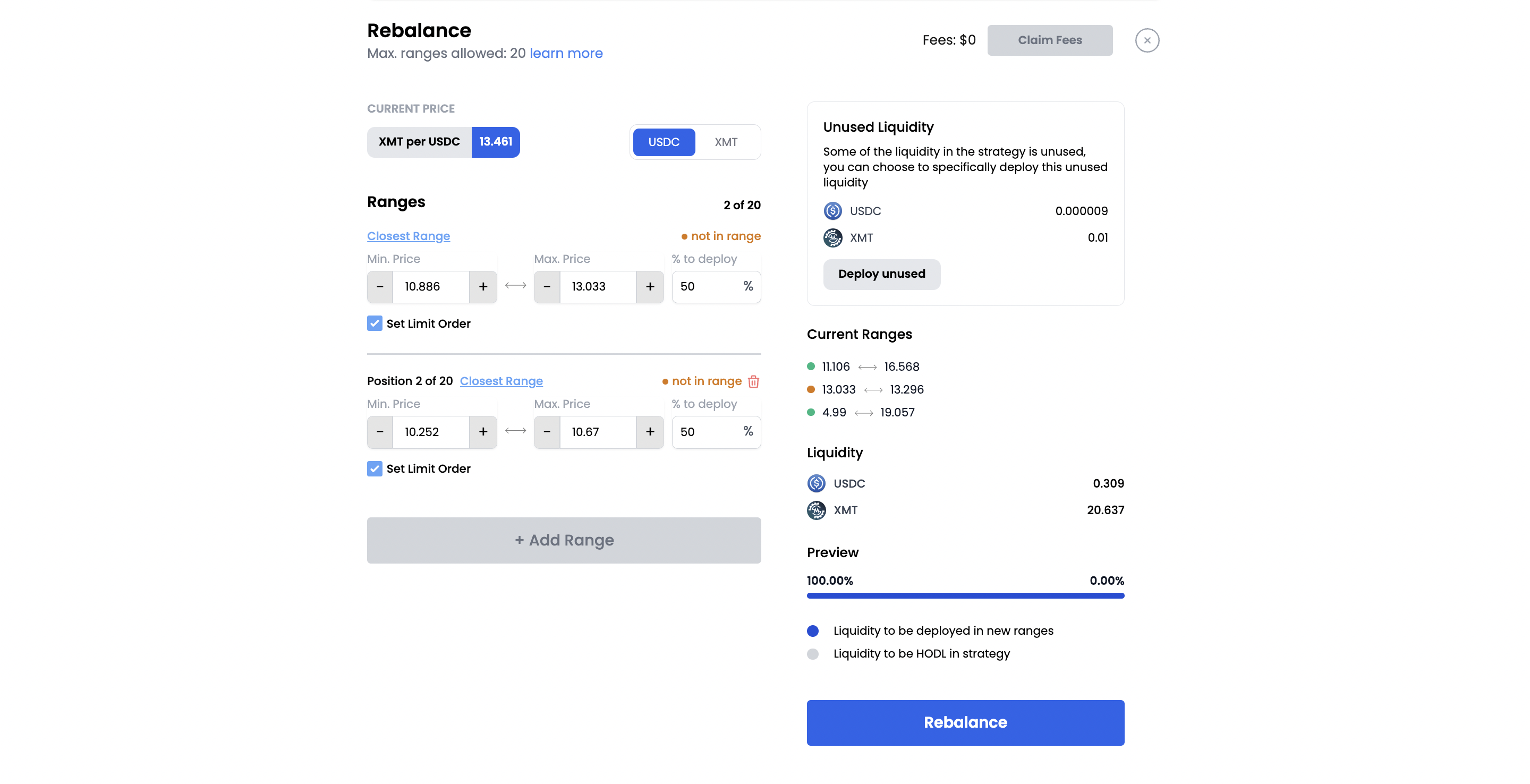

DefiEdge allows strategy managers to allocate liquidity in up to 20 different positions on UniswapV3 in one go. We do the maths for you so that you do not have to worry about calculating the exact ratio of tokens you need if your analysis tells you to place liquidity on n-teen different positions in n-teen different ways. Just tell the app your ranges and the proportion of liquidity in these ranges, and we will tell you exactly how you need to swap your token to deploy your liquidity efficiently. You will then get access to the deepest liquidity in the market to perform your swaps through our native integration with 1Inch.

|

|---|

|

|---|

|

|---|

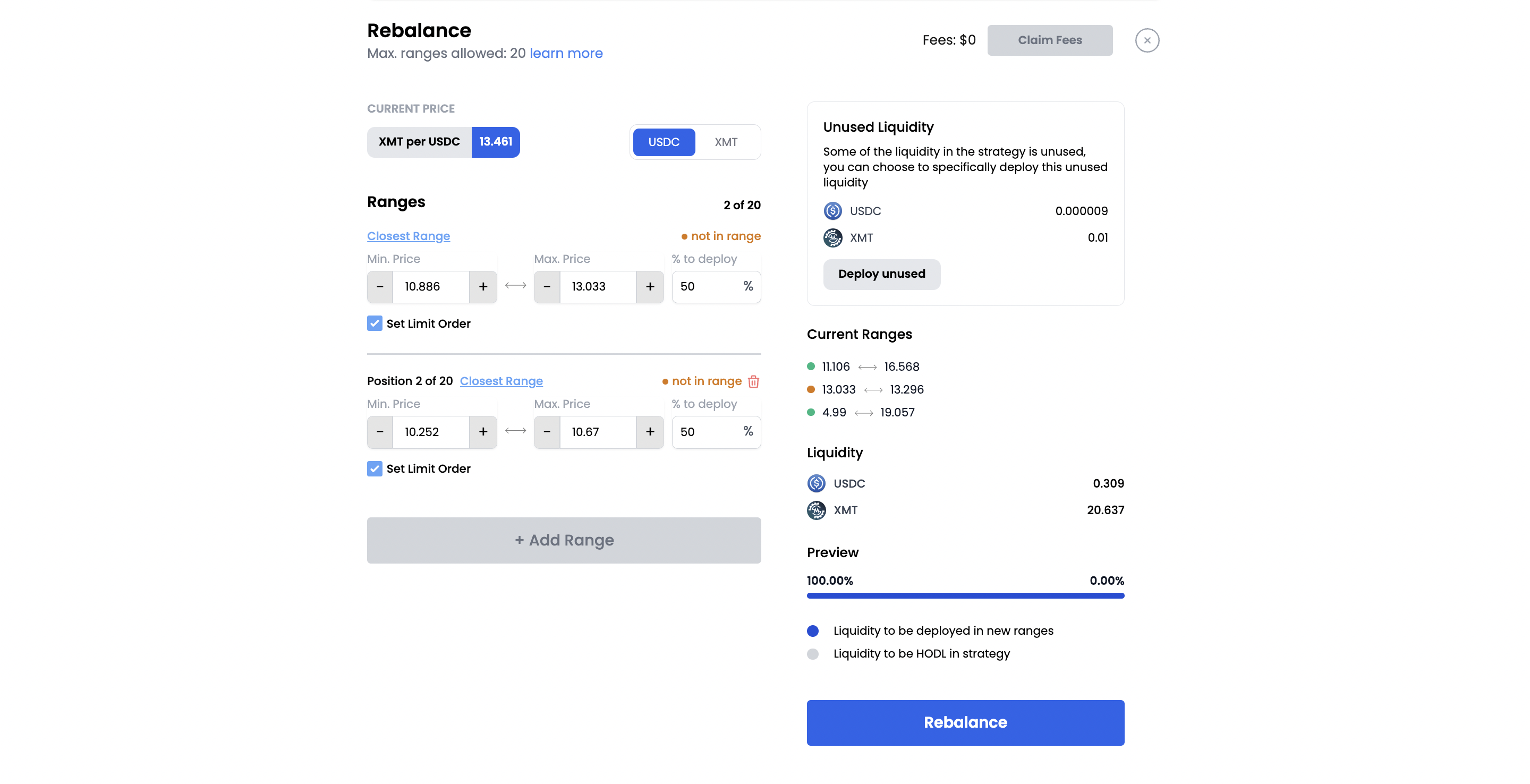

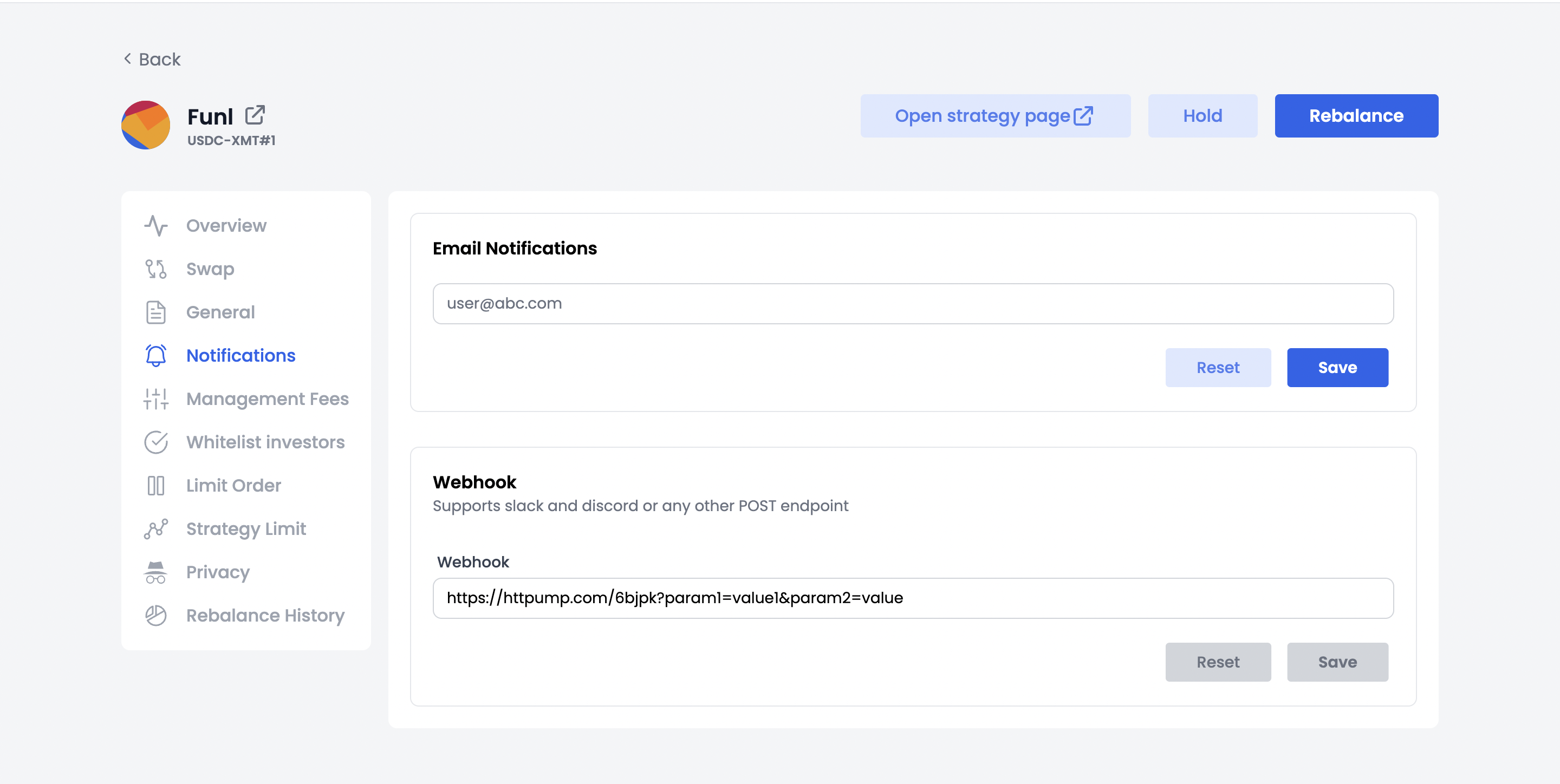

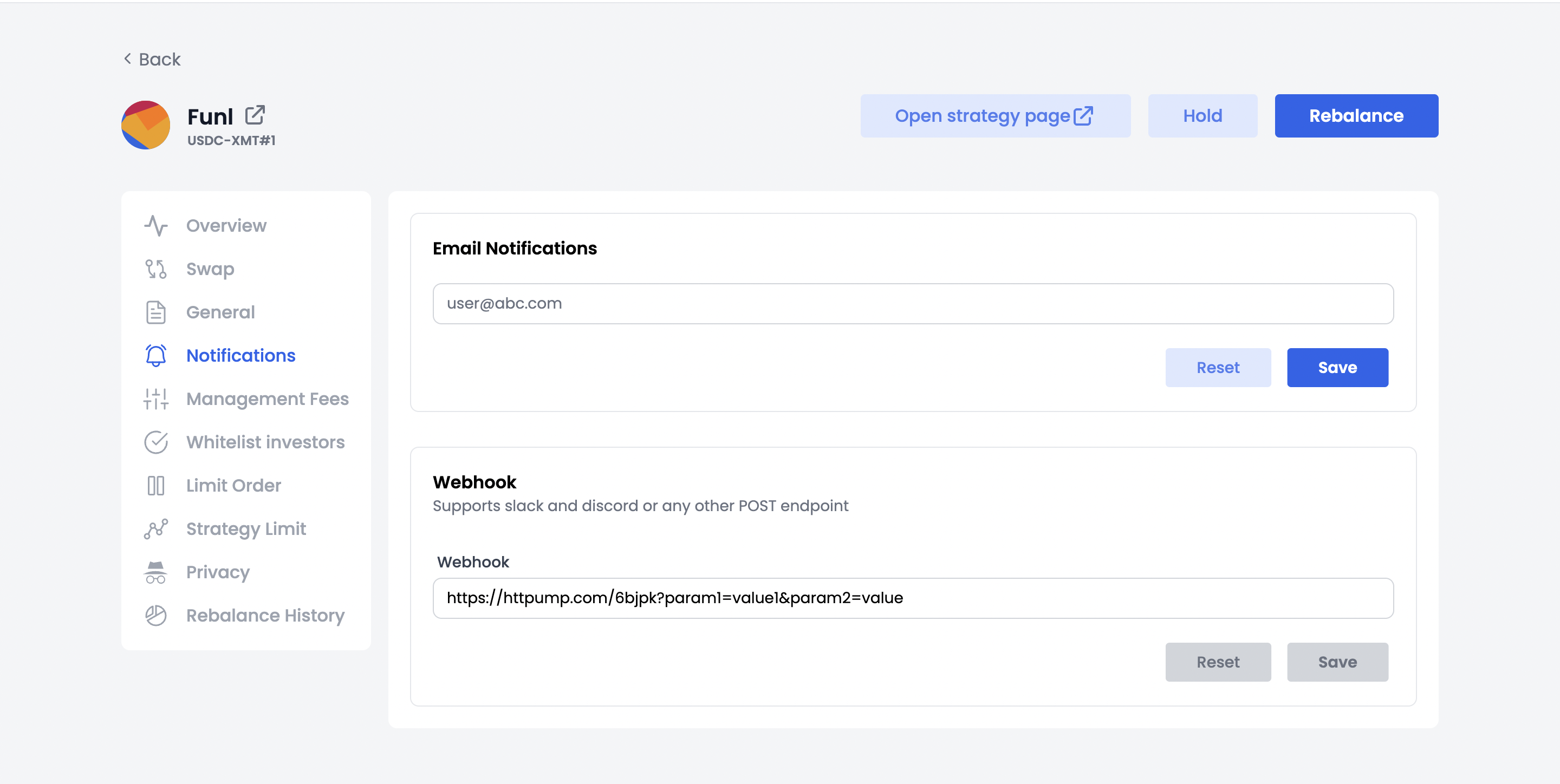

With DefiEdge you can keep track of all your positions. Deploy webhooks to your strategy that will trigger notifications to your Slack/Discord channels notifying you whenever a position goes out of range. We have also integrated with Gelato to bring limit/range orders onto decentralized exchanges. All you need to do is decide the price range and check the box beneath. For example, if the current price of WETH in the WETH-DAI pool is $1500, you can choose a price range around $1600 and set it as a limit order. Whenever the price goes above $1600, your WETH will automatically get sold as WETH, and our contracts will remove your liquidity. You get set limit orders while earning fees.

|

|---|

|

|---|

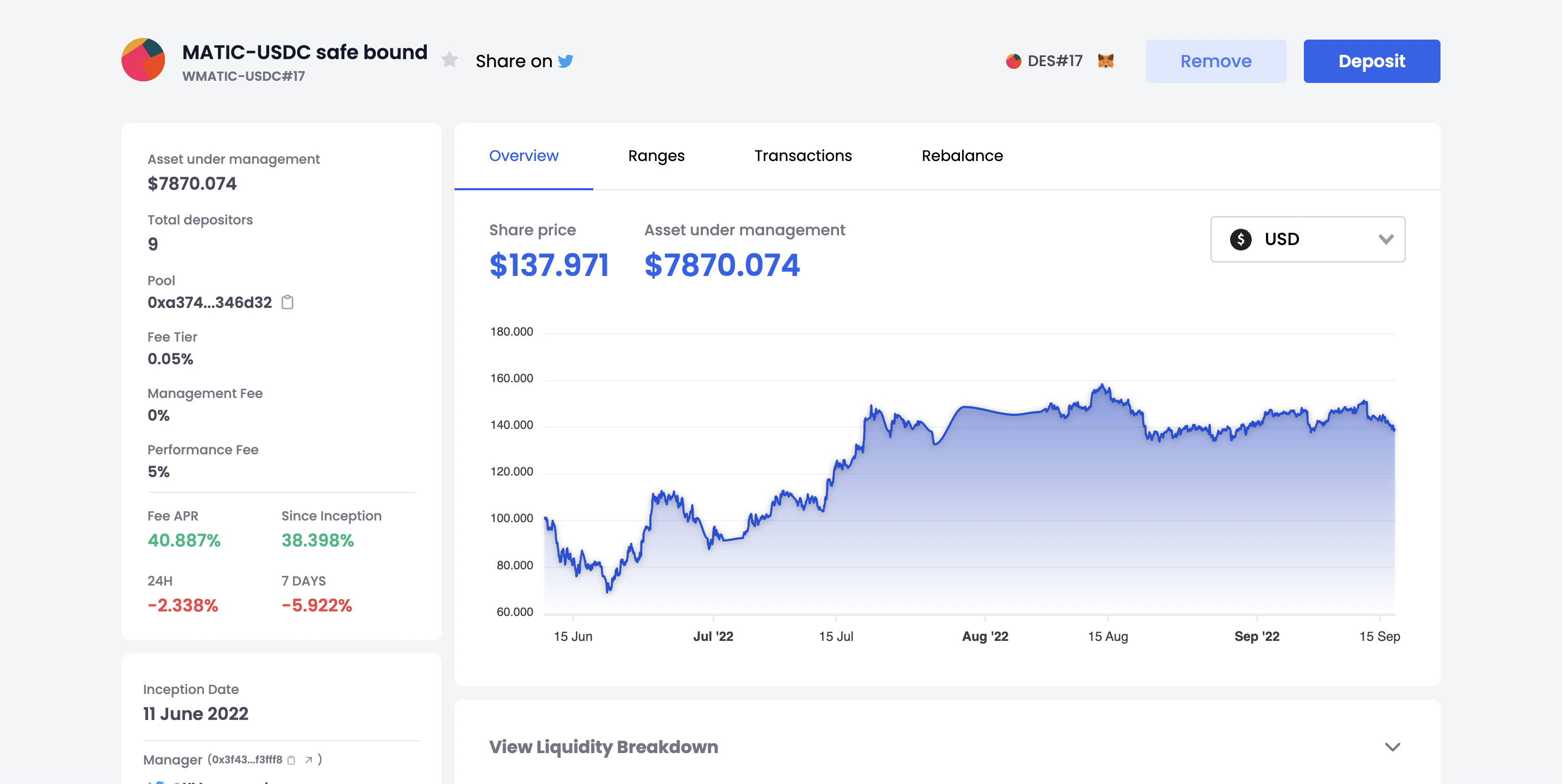

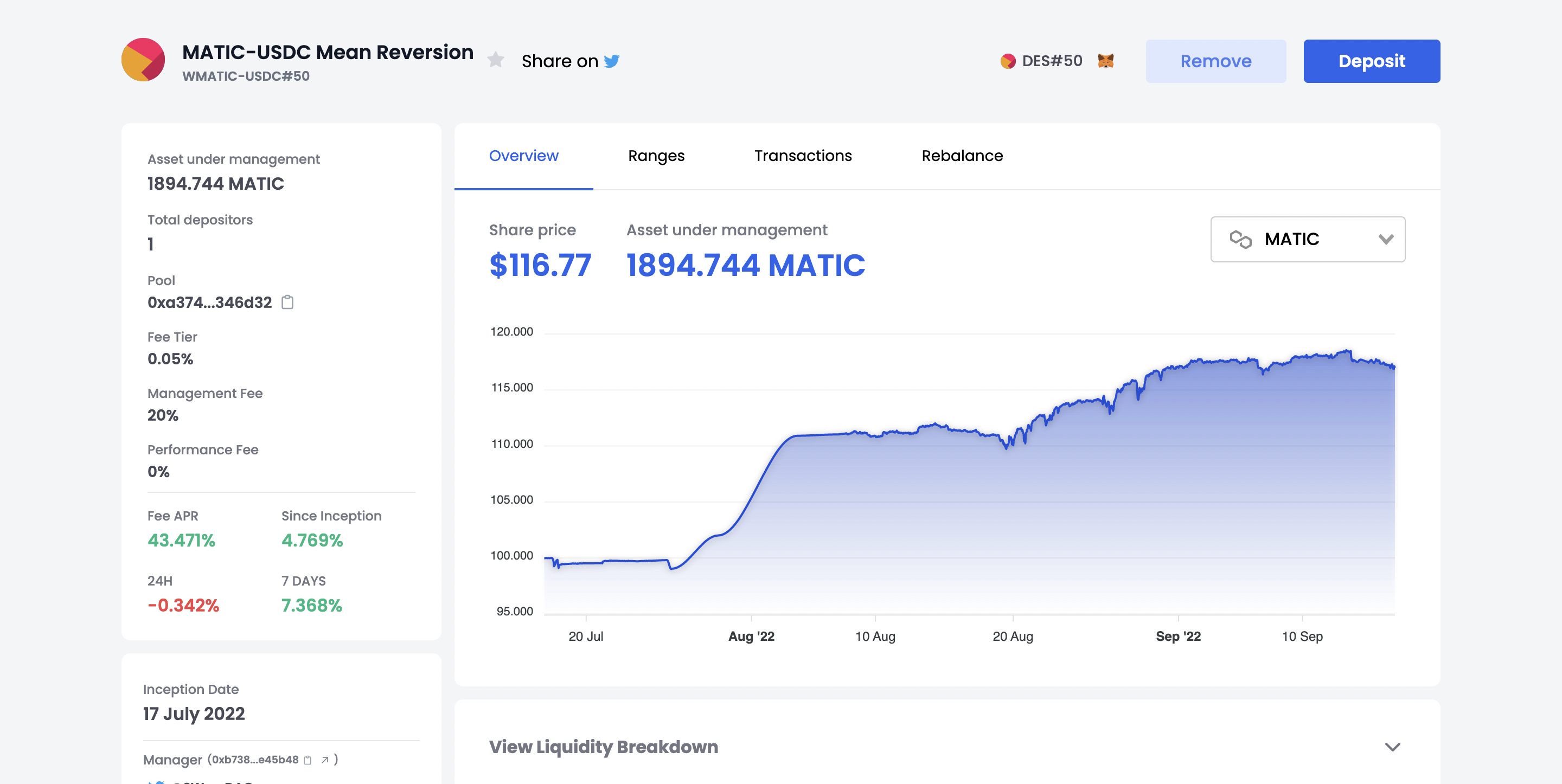

The most exciting part is that, if you are an efficient strategy manager, you can share your success with others in exchange for a fee, you can even keep it private to share with a select set of users. Using our share-token mechanism passive yield seekers can gain exposure to your nimble market manoeuvres. If they feel that your historical performance has been good, passive token holders can deposit their tokens into your strategy. You can choose to charge them any percentage of a one-time management fee along with an additional performance fee.

What are you waiting for? Create your strategy today on DeFiEdge.